Description

General Info

Warren Buffett once said that it is wise for investors to be

“fearful when others are greedy, and greedy when others are fearful.”

**Many inexperienced investors are worried during the time of crisis such as Covid, where the experts investors are on buying spree during this period of time. Know the differences in Mentality & Mindset between both types of investors. (Have the correct mindset, to be a Winner.)

COVID 19, has also taught us "Never to Depend on a Single Income, Make Investment to Create a Second a Source",

90% of enquires are people who has never buy or invested in a business. (Even existing business owners whom are looking to buy or invest in businesses mostly have also not purchase or invested in a SME business before and does fully understand the market.)

Most enquires do not even know what are they actually looking for. They could not even identify when a good business opportunity is in front of them.

Absorb, Learn and Listen to Us because we are 1 of the top experienced business broker in Singapore. We have more than 200 over businesses transaction. WE ARE NOT ASKING YOU TO LISTEN TO US BLINDLY BUT RATHER ASK YOURSELF WHAT WE SHARED IF IT'S LOGICAL!

Before we start, if your MAIN OBJECTIVE is wanting your money to work harder for you / get better returns than what the banks/norms are offering / looking for something passive and without much other objectives than THIS IS THE ONE FOR YOU! (People who has too much objectives usually does not get started)

Buyers/Investors should;

1. List down ONLY 1 to 3 of your main objectives (any more than 3, you will hardly find anything suitable in the market.)

2. Know what is a reasonable return for your investment?

3. Know your budget.

We will ask you the above questions.

Identifying To You Why is This Such a Good Business Opportunity

More Than 60 Years History

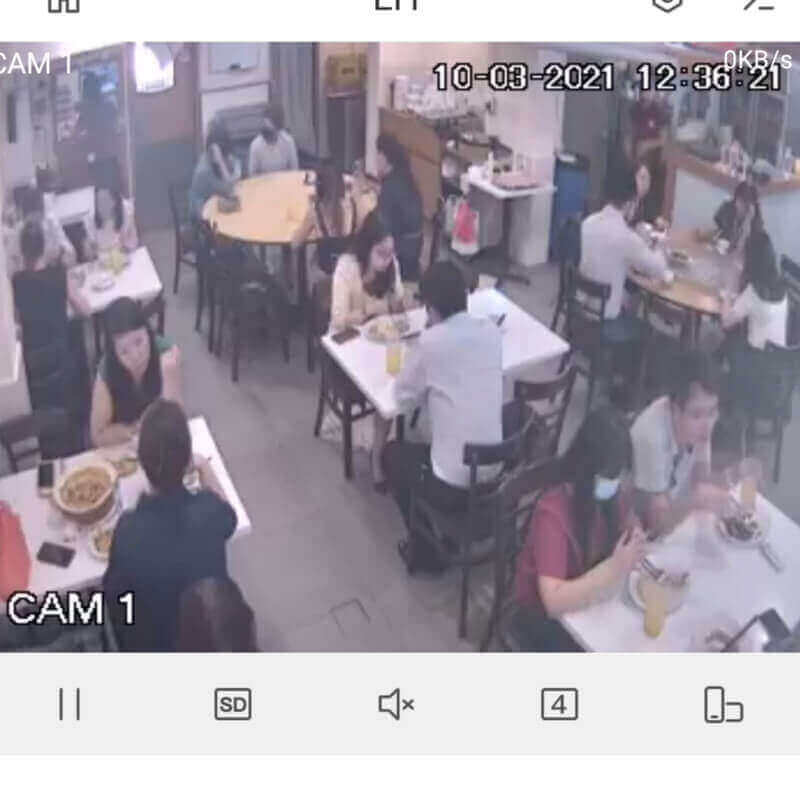

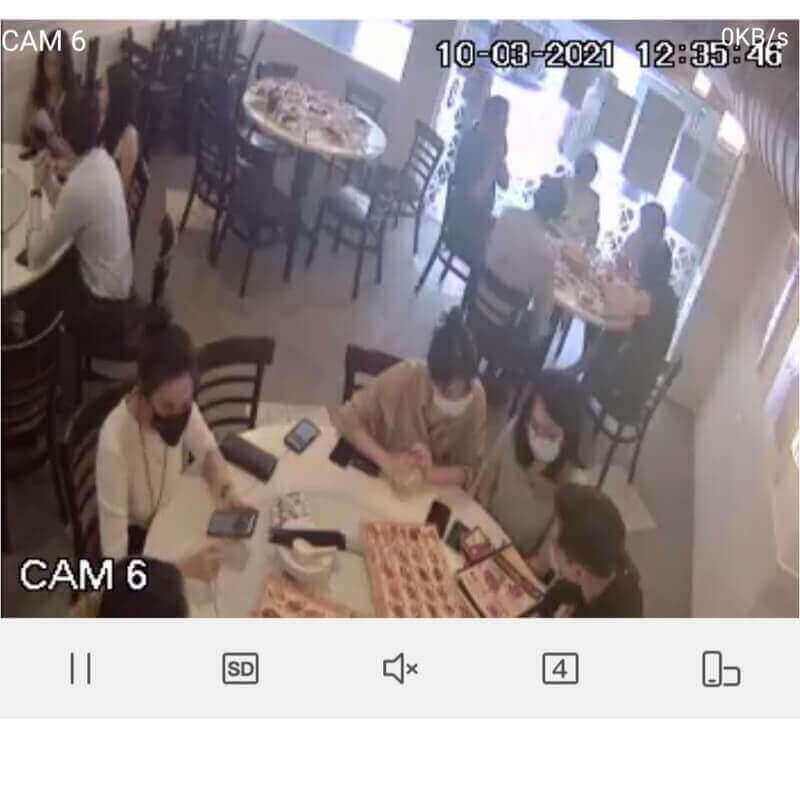

1. This is a Chinese Seafood Restaurant with more than 60 years history. (Search online if there is any business history more than 60 years that allows you to purchase/invest in them.)

Manage to find any, would you be keen?

3 Months Trial (Test the business for 3 months)

2. If this business gives you a 3 Months Trial (Note that this 3 Months Trial is unheard of in the market)(we show you a Guaranteed 3 months performance before committing and allows you to attend its monthly Shareholders Meeting to know the business better)

Isnt it awesome? Would you be ready to join?

Good Price

3. If this business make $400k net profit a year and you manage to buy it for $800k.

Is it a good buy to you?

Low Entry Investment

4. With such profits above,

Do you think a budget of $25k or $100k can be the shareholder of the business?

Good ROI

5. Conservatively return of 15% to 45% per annum.

Is such returns attractive to you?

Quaterly Hand-Out of Profits

6. Is quarterly(3months) handout of profit is appealing to you? (Most businesses handout profits after 12 months as financial year closes)

Good for you?

Proper Due-Diligence

7. Ask other business opportunities if a proper Due-Diligence is conducted? We have spent more than $35k engaging a 3rd party Lawyer and Accounting Firm for the DD of this business.

Ease of Exit

8. An ease exit is created, therefore you could exit by selling your shares anytime.

Good Enough? (you can enter and exit anytime you wish to)

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

*Up to 90% of shares sold, only remaining about 10% shares to be bought.

Once it meets your objectives take a serious consideration about it. Don’t 2nd Guess but rely on statics and information.

Low Investment Entry - $25k to $100k (Does this amount suit your budget range?)

The Entry for Purchasing A Good Profiting Biz is High! – Especially if your investment budget is less than SDG$200k (even a $200k budget will only get you the most basic entry level of a good business). (Min. Hundreds of Thousands, better ones are in the Millions).

Even you have a good investment budget, it’s not cherry picking for you. There are tons of money in the market waiting for good business to be purchased.

Majority of investing options that you can find are asking for investment into something new, such as a new outlet, a new service, a new business, a new product, etc. In short, No History, No Actual Data, No Tractio.

Therefore, this is the ONLY BEST Business option for you to invest if your investment budget is LOW.

This Brand has a history of more than 60 years, with multiple outlets in Singapore.

If ONLY you find the above attractive, contact us and we will invite you asap to the business place itself where in-depth information, financials and Due-Diligence Report will be shared. (Kindly visit us asap as shares is limited, first come first served)

Looking forward to investors that are good and ready to go. Contact us at +65 93559531

Visit Us at www.aci.com.sg for more information