Description

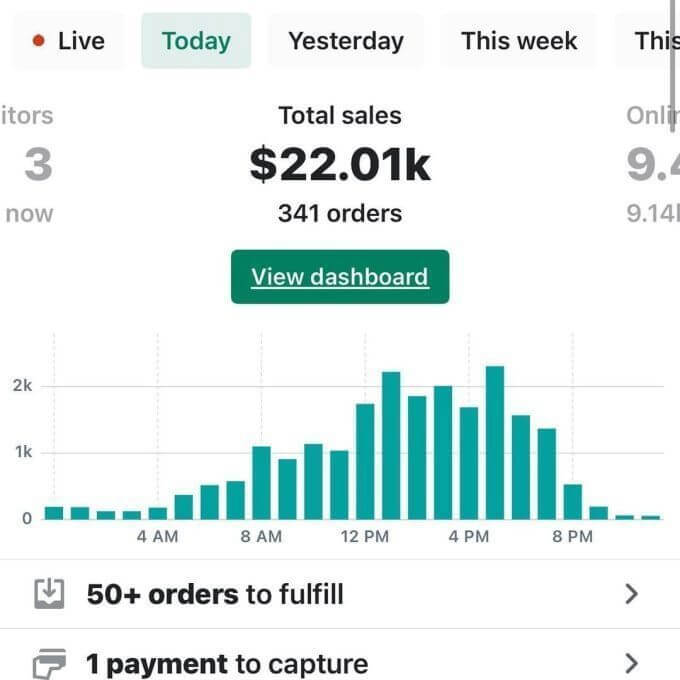

You've been researching acquisitions for months. Maybe you've even found a listing that looks promising.

Then you start asking questions.

And suddenly, that promising listing feels like a minefield.

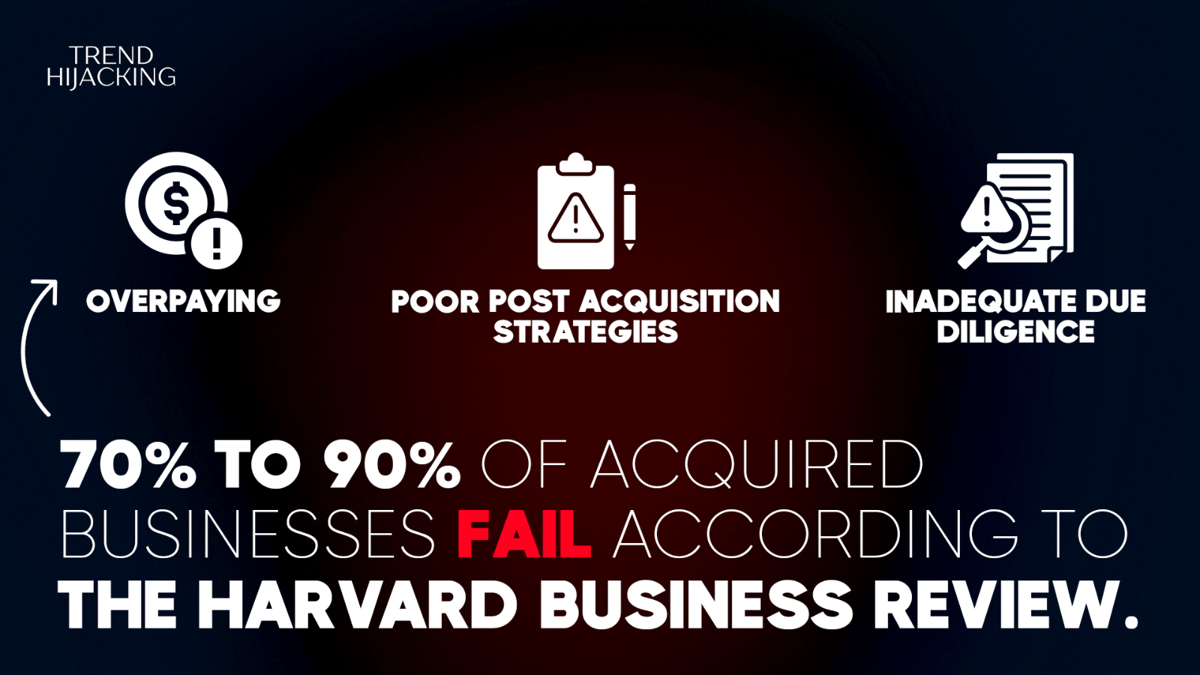

This is exactly why 70-90% of acquisitions fail, according to Harvard Business Review. It's not that the businesses are bad—it's that buyers don't know what they don't know until it's too late.

Trend Hijacking's Acquisition Program exists to solve this exact problem.

We're not a marketplace showing you listings.

We're not a broker connecting you with sellers.

We're a full-service partner that conducts institutional-grade due diligence on your behalf, then manages the entire operation post-acquisition.

Here's what our process looks like:

We start by sourcing deals off-market, which means we're not competing with dozens of other buyers on public listings.

We have relationships with business owners who are considering selling but haven't listed publicly yet. This gives us negotiating leverage we consistently buy 20-40% below market value.

Then comes forensic analysis.

Our team reviews every line item in the P&L.

We look for the red flags that casual buyers miss: single-product dependency, platform policy violations, inflated valuations based on economic spikes that won't recur, supplier concentration risk, declining unit economics masked by top-line growth.

And we don't stop at financial due diligence. We assess operational complexity.

Can this business be systematized? Can we install a manager, or will it require constant owner involvement?

If it's the latter, we walk away because our model is about buying income, not jobs.

Once we've identified a solid opportunity and negotiated favorable terms, we move into our 4-step process: strategic acquisition (already done), brand enhancement, accelerated growth, and profitable exit.

Brand enhancement means we're not just accepting what we bought we're optimizing it.

Growth acceleration is where our operational expertise compounds.

We implement proven marketing strategies. We fix inefficiencies in fulfillment. We target 5-10× growth over 1-2 years.

The exit is where all this work pays off.

E-commerce businesses typically sell for 2.5-4× annual profit. When you buy below market, scale aggressively, and position at premium multiples (3-5× EBITDA), you're looking at 100-150%+ returns over 2 years.

But here's what makes this different from going it alone: you're not the one conducting due diligence.

You're not the one negotiating with sellers. You're not the one trying to figure out if the numbers are real.

Our team with $41.5 million in managed e-commerce sales does all of that for you.

And post-acquisition, you're not the one running the business.

We handle operations, marketing, fulfillment. We install management teams. You review progress reports and watch your asset appreciate.

Our clients rate us 4.5/5 on Trustpilot, and they consistently mention that working with us gave them confidence they couldn't get elsewhere. One client said the team made the process "less intimidating" because they handled all the details.

We offer a free 14-day trial no commitments, no pressure. Just a transparent look at how we operate and the level of diligence we bring to every deal.

Look, buying a business without proper due diligence is gambling. And you're not a gambler you're an investor who wants to make intelligent decisions backed by data and expertise.

We've built the systems. We've proven the model. We've done the deals. The question is: are you going to keep trying to navigate this alone, or are you ready to partner with a team that's done this dozens of times?

Plus we give you insider access to see our processes and gain clarity on whether this opportunity is right for you.

Schedule a 1:1 consultation with one of our consultants today